TAKE YOUR MEDICINE…IF YOU CAN AFFORD TO

Beginning in 2024 most medicare drug plans will have a $545 deductible. This adds to the upfront costs of your medications. First tip when looking at medicare drug plans is check the deductible. It can cost you if you don’t.

What is a Prescription Drug Deductible? It’s the portion of the drug plan that requires you pay full costs of medicines until the deductible is met – BEFORE Medicare copays begin. To make things more complicated, the deductible may or may not apply to lower tier drugs (Tiers 1 & 2). So look at the fine print on your drug plan and determine which Tiers the deductible applies to so you are not surprised by costs.

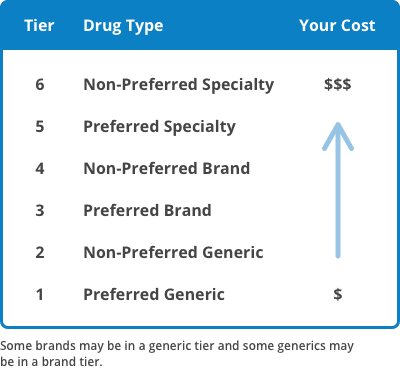

Taking a closer look at a Medicare Drug Plan. Every plan has 6 Tiers and 4 phases to a drug plan. First let’s look at the Tiers:

The higher the number of the Tier, the higher the price of the drug. Preferred generics generally have $0 copays; some drug plans will also price generics at $0 copays…so look closely — the drug plan you choose may have a huge impact on your bottom line.

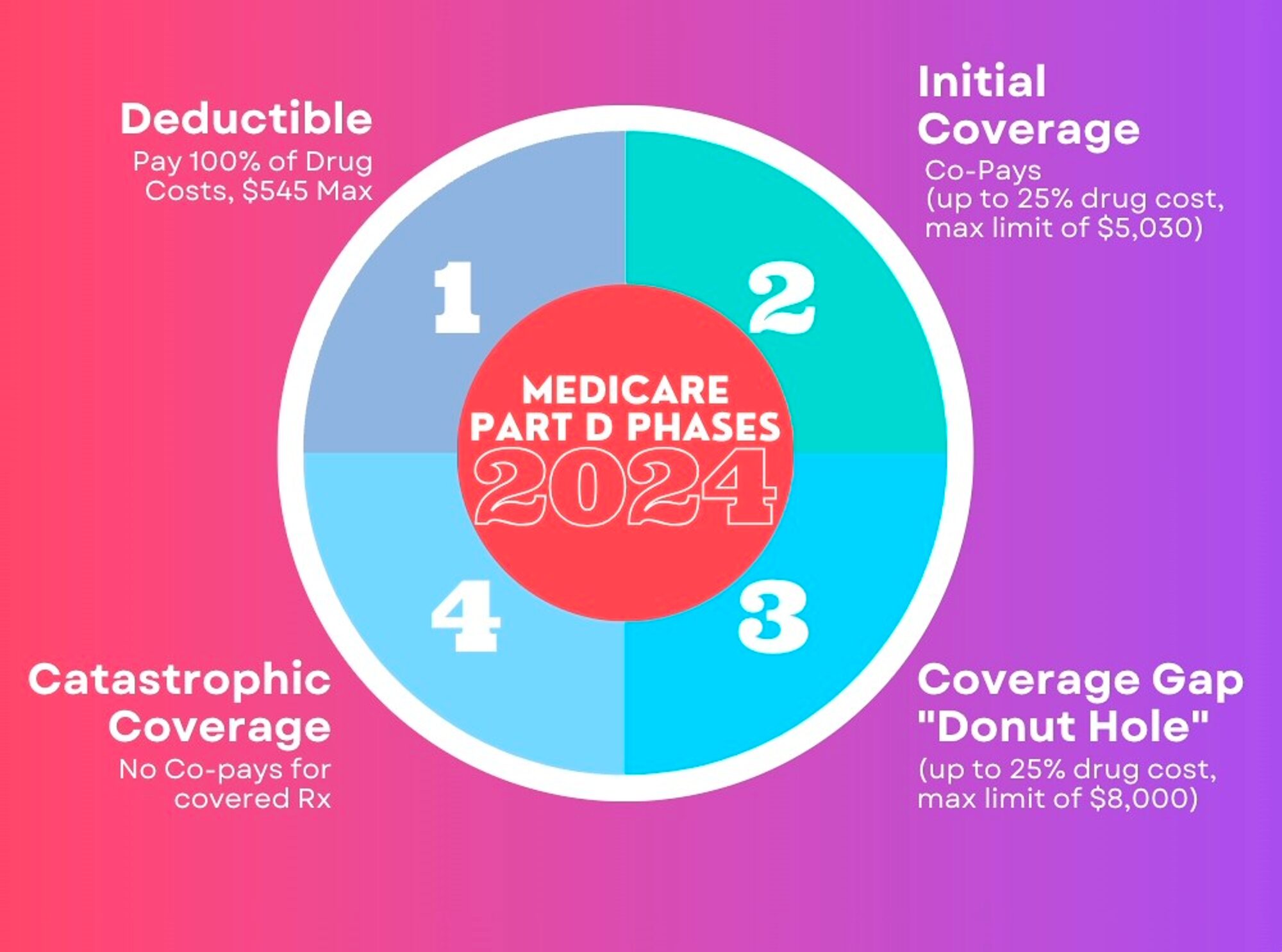

In addition to the drug Tiers, there are also 4 Phases to a drug plan…because, why make it easy? The 4 Phases of a drug plan are:

- Deductible – set at $545 for 2024 on most medicare plans

- Initial Coverage – set copays or % co-insurance after deductible is met (if applicable)

- Donut Hole/Coverage Gap – 25% co-insurance on cost of meds (this is the phase that typically costs the most)

- Catastrophic – in 2024 all meds will go to $0 in this phase

Here is look at the 4 Phases and costs in each phase in 2024:

There is no way to avoid the ugliness of a Medicare drug plan… BUT WARNING TO ALL: YOU MUST HAVE A MEDICARE DRUG PLAN IN EFFECT REGARDLESS OF WHETHER OR NOT YOU TAKE ANY PRESCRIPTION MEDICINES. FAILURE TO DO SO WILL RESULT IN LIFETIME PENALTIES/FINES BEING IMPOSED.

TOOLS TO HELP OFFSET THE COSTS OF MEDICINES ON A MEDICARE DRUG PLAN

Medicaid:

Medicaid is state run health insurance. This is awarded based on financial need – but when combined with medicare it is the greatest safety net your drug costs can have. If you have medicaid, you qualify for medicare advantage plans that can reduce the costs of meds to $0 for the entire year.

Extra Help:

Extra Help is a national prescription drug subsidy program run by Social Security. Also based on financial need, but not as strict as medicaid. If you qualify, your med costs are capped at no more than $11.85 in 2024 – regardless of medicine. It also protects you from any drug plan premiums, stabilizes costs through all phases of the drug plan, and eliminates any penalties for late enrollment. To apply, call social security at 1-800-772-1213.

SPAP:

SPAP stands for State Pharmaceutical Assistance Programs — these are much under-utilized subsidy programs run by the state. Search your state and the term SPAP to find out the application process for your state.

Patience Assistance Programs:

There are so many astronomically-priced medicines that are untouchable for the majority of people unless they have some sort of extra help. Drug manufacturers know this. They are the ones who “over”price the medicines aren’t they? So they have Patient Assistance programs you can apply for if you are unable to secure any of the above mentioned subsidy programs. If you qualify, you can get tremendous discounts on the costs of those medicines that otherwise could wipe out your retirement savings. Just search the medicine name and patient assistance program and you will find the info you need to apply. Go direct to the manufacturer and ask for help.

Coupons/Discount Programs:

Good Rx. SingleCare. ScriptSave by WellRx. These are just a few — but the best — of the current discount prescription coupon programs available. You can enroll online for free. Download the apps for these programs and use them to add to the savings for the cost or your prescriptions drugs — these discounts are applied at the pharmacy at the time of payment.

Switch to Generics

Typically there is a generic medicine for most name brand drugs. If you are on an expensive name brand medicine, consult with your doctor to see if there is a lower cost generic that can be prescribed instead. If not, look into some of the above programs to help offset costs and make your medicines a more affordable part of your health care.

In the vast landscape of online advertising, particularly on social media platforms like Facebook, it’s not uncommon to come across enticing offers that seem too good to be true. One such example is the often-promoted $3000 grocery card, capturing the attention of many unsuspecting users. However, it’s crucial to dig deeper and understand the fine print behind this seemingly generous offer, as it’s not as straightforward as it appears. In this post, we’ll unravel the truth behind the $3000 grocery card Facebook ad, exposing the misconceptions and shedding light on the reality of its availability and eligibility.

In the vast landscape of online advertising, particularly on social media platforms like Facebook, it’s not uncommon to come across enticing offers that seem too good to be true. One such example is the often-promoted $3000 grocery card, capturing the attention of many unsuspecting users. However, it’s crucial to dig deeper and understand the fine print behind this seemingly generous offer, as it’s not as straightforward as it appears. In this post, we’ll unravel the truth behind the $3000 grocery card Facebook ad, exposing the misconceptions and shedding light on the reality of its availability and eligibility. Navigating the intricacies of Medicare can be challenging, especially for individuals with specific healthcare needs. Two options that stand out in providing tailored care are the Chronic Special Needs Plan (CSNP) and the Dual Special Needs Plan (DSNP). In this blog post, we’ll delve into the details of CSNPs and DSNPs, exploring the different types available, the qualifications required, and the unique benefits they offer. It’s important to note that, in addition to having a qualifying condition and dual eligibility for DSNPs, both types of plans offer enhanced additional benefits, including grocery cards, generous dental, vision, and hearing benefits, in addition to zero to minimal cost-sharing for care. Many of these plans also offer care management services to make sure you are optimizing and coordinating the care the plan provides.

Navigating the intricacies of Medicare can be challenging, especially for individuals with specific healthcare needs. Two options that stand out in providing tailored care are the Chronic Special Needs Plan (CSNP) and the Dual Special Needs Plan (DSNP). In this blog post, we’ll delve into the details of CSNPs and DSNPs, exploring the different types available, the qualifications required, and the unique benefits they offer. It’s important to note that, in addition to having a qualifying condition and dual eligibility for DSNPs, both types of plans offer enhanced additional benefits, including grocery cards, generous dental, vision, and hearing benefits, in addition to zero to minimal cost-sharing for care. Many of these plans also offer care management services to make sure you are optimizing and coordinating the care the plan provides. For individuals not currently relying on prescription medications, the idea of investing in a Medicare Prescription Drug Plan might seem unnecessary. However, the importance of having prescription drug coverage extends beyond immediate medication needs. In this blog post, we’ll explore the reasons why having a Medicare Prescription Drug Plan is crucial, touching on the potential penalties for non-compliance and discussing alternative creditable coverage options.

For individuals not currently relying on prescription medications, the idea of investing in a Medicare Prescription Drug Plan might seem unnecessary. However, the importance of having prescription drug coverage extends beyond immediate medication needs. In this blog post, we’ll explore the reasons why having a Medicare Prescription Drug Plan is crucial, touching on the potential penalties for non-compliance and discussing alternative creditable coverage options. Lets get down to basics — Medicare is as easy as A,B,C & D

Lets get down to basics — Medicare is as easy as A,B,C & D Navigating Medicare Options: Understanding the Differences Between Medicare Supplement/MediGap Plans and Medicare Advantage Plans

Navigating Medicare Options: Understanding the Differences Between Medicare Supplement/MediGap Plans and Medicare Advantage Plans