When it comes to navigating eligibility for Medicare benefits, two terms that often come up are SSI and SSDI. While they may sound similar, they are distinct programs with different eligibility criteria and purposes. Understanding the differences between Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) can be crucial for individuals seeking financial support due to disabilities. Let’s delve into these two programs and explore how they differ.

What is SSI?

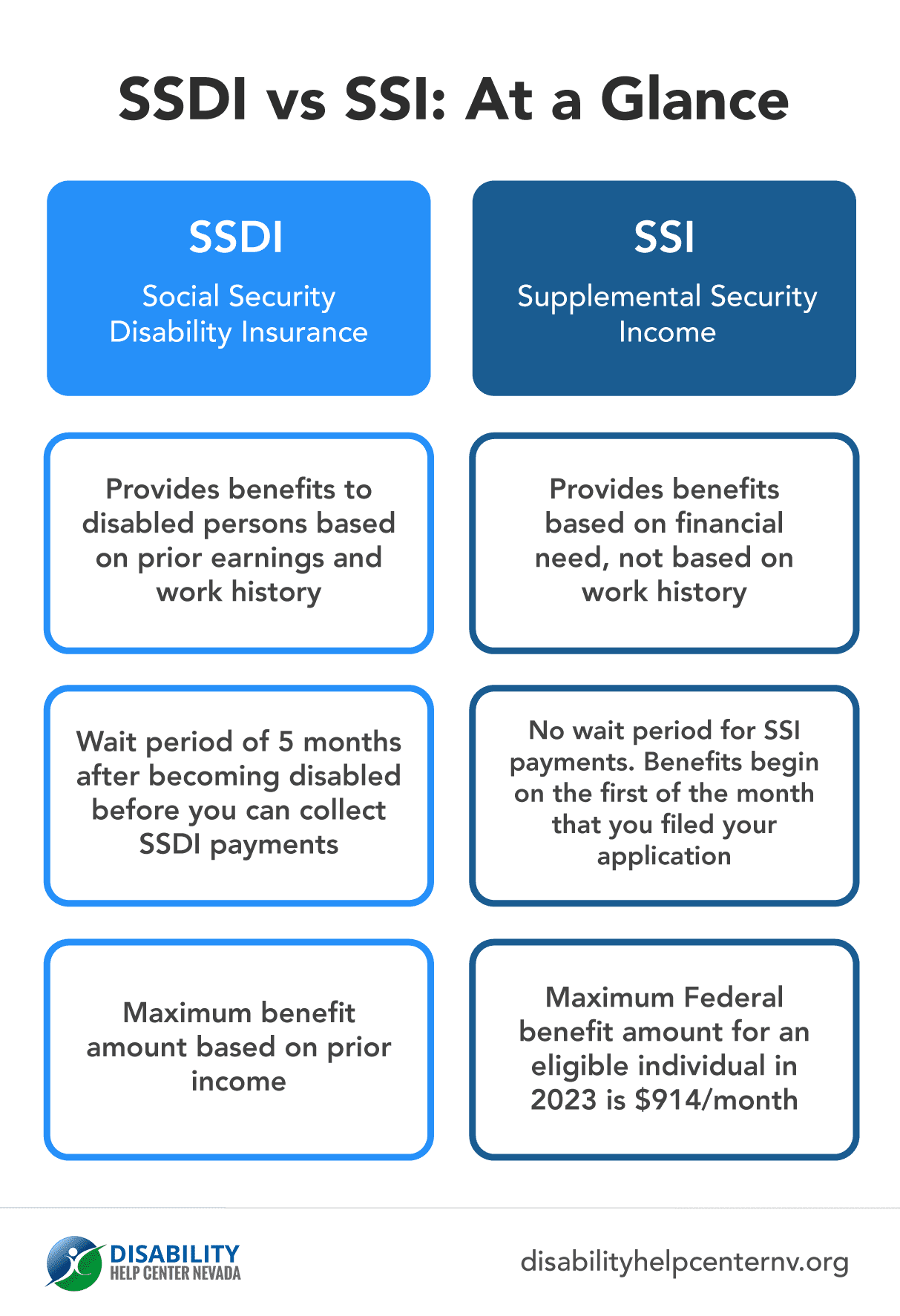

Supplemental Security Income (SSI) is a federal program designed to provide financial assistance to disabled individuals who have limited income and resources. It is a needs-based program, meaning eligibility is determined based on financial need rather than work history. SSI benefits are intended to help individuals meet their basic needs such as food, shelter, and clothing.

To qualify for SSI, applicants must meet the following criteria:

- Limited Income: Applicants must have limited income, which includes earnings, pensions, and other sources of financial support.

- Limited Resources: Individuals must also have limited resources, including cash, savings, and assets such as property and vehicles.

- Disability: Applicants must have a disability that prevents them from engaging in substantial gainful activity (SGA) and is expected to last for at least 12 months or result in death.

What is SSDI?

Social Security Disability Insurance (SSDI) is another federal program that provides benefits to disabled individuals. Unlike SSI, SSDI is based on work credits earned through employment and is not strictly income-based. Individuals who have worked and paid Social Security taxes for a certain number of years may be eligible for SSDI benefits.

To qualify for SSDI, applicants must meet the following criteria:

- Work Credits: Applicants must have earned a sufficient number of work credits by paying Social Security taxes through their employment history. The number of work credits required depends on the individual’s age at the time they become disabled.

- Disability: Applicants must have a disability that meets the Social Security Administration’s (SSA) definition of disability, which is similar to the criteria for SSI.

Connection to Medicare

One significant difference between SSI and SSDI is the connection to Medicare. Individuals who receive SSDI benefits are eligible for Medicare coverage after a waiting period of 24 months from the date they become entitled to SSDI benefits. This means that SSDI beneficiaries have access to healthcare coverage through Medicare, which can help alleviate the financial burden of medical expenses.

On the other hand, individuals who receive SSI benefits typically do not qualify for Medicare. Instead, they may be eligible for Medicaid, which is a separate program that provides healthcare coverage to low-income individuals and families. Medicaid eligibility varies by state, and recipients may receive assistance with medical expenses such as doctor visits, prescription medications, and hospital stays.

While both SSI and SSDI provide financial assistance to disabled individuals, they differ in eligibility criteria and the connection to healthcare coverage. SSI is a needs-based program that is income and resource-sensitive, whereas SSDI is based on work credits earned through employment. SSDI is the only one that qualifies you for Medicare Parts A & B Benefits after a 24-month period.Understanding these distinctions can help individuals determine which program they may be eligible for and navigate the process of applying for Social Security benefits effectively.