As our loved ones age, managing their well-being and healthcare becomes critical. Among the myriad of considerations, and often overlooked, the type of Medicare coverage you choose can make or break you. From chronic conditions to financial resources, to the level of independence your loved one has, there are so many variables to consider. Let’s face it. It’s not easy. And the level of care needed can fluctuate on a moments notice. The challenges can seem never-ending.

How do you cope? Where do you turn? What do you do? Let’s break it down:

Critical Issues to Consider:

- Age and Health Issues: Aging often brings about various health challenges that require specialized care and attention. Plan accordingly.

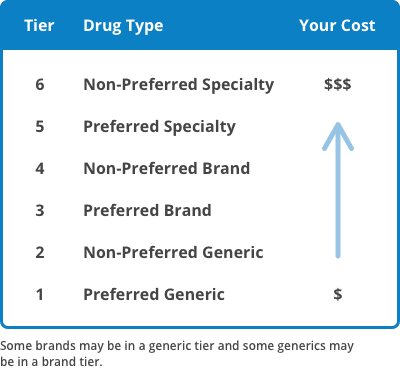

- Chronic Conditions and Medications: Chronic conditions such as diabetes, heart issues, cancer and neurological diseases require consistent monitoring and treatment. Evaluating the required medications and their coverage under Medicare plans is essential for effective cost management.

- Independence and Activities of Daily Living (ADLs): Assessing the individual’s ability to perform daily activities independently is crucial. Depending on their level of independence, additional support or specialized care may be required.

- Financial Resources: Financial considerations play a significant role in determining the most suitable Medicare coverage.

- Transportation Needs: Access to transportation is vital for attending medical appointments, acquiring medications, and engaging in social activities. Can your loved one drive? Use public transportation, or access an uber?

Chronic Conditions: Managing chronic conditions is challenging. Managing someone else’s chronic condition only compounds the difficulty. Let’s take a look at some of the most common ones:

- Diabetes: Diabetes requires regular monitoring of blood sugar levels, medication adjustments, insulin shot management and lifestyle modifications. Individuals with diabetes may need to see an endocrinologist, a podiatrist for foot care, an ophthalmologist for eye exams.

- Cardiovascular Health: Heart disease necessitates close monitoring of blood pressure, cholesterol levels, and heart function. Patients may require visits to cardiologists for specialized testing (e.g., echocardiograms, stress tests) and interventions (e.g., cardiac catheterization, pacemaker implantation).

- COPD: Conditions like COPD or asthma may require consultations with pulmonologists for pulmonary function testing, bronchodilator therapy, and oxygen therapy management.

- Cancer: From oncologist visits to hospital visits to radiation, chemotherapy, and medication management, we all know this treatment protocol takes alot of support and time.

- Kidney Disease: Advanced kidney disease requires dialysis – which typically involves visits 3 times weekly to dialysis clinics for 4-6 hours at a time.

- Arthritis and Musculoskeletal Disorders: Individuals with arthritis or musculoskeletal disorders need a rheumatologist or orthopedic specialist for pain management, joint injections, physical therapy, and surgical interventions if necessary.

- Neurological Conditions: Neurological disorders such as Parkinson’s disease, Alzheimers or multiple sclerosis may require visits to neurologists for symptom management, medication adjustments, and coordination of care with other healthcare providers.

None of the above chronic conditions are easy to manage. Knowing the types of doctors you need to see for each condition is a good start. Making a detailed list of prescription medications, dosage (mg), and number of doses a day required, is another must have. While you are making that list, make one of all the doctors your loved one has and what condition they treat. Also document which doctor is prescribing each medication. Keep this file current and easy to access.

MANAGING HEALTHCARE DECISIONS

First word of advice. If you re going to be making healthcare decisions for your loved one, get a Durable Medical Power of Attorney

You can find sites online to download a durable medical power of attorney (POA) form if you wish do-it-yourself. However, even if you prepare your own medical power of attorney document, it’s always smart to consult with an estate planning attorney who can tell you which documents you will need for your particular situation and needs.

Having a Medical POA is critical as it removes decision-making barriers for healthcare. In situations where immediate decisions are required, having a designated individual with Medical POA ensures timely and appropriate medical care without legal barriers. It also allows you to handle medicare coverage decision making, and control how you will cover the healthcare costs.

MEDICARE MATTERS…alot

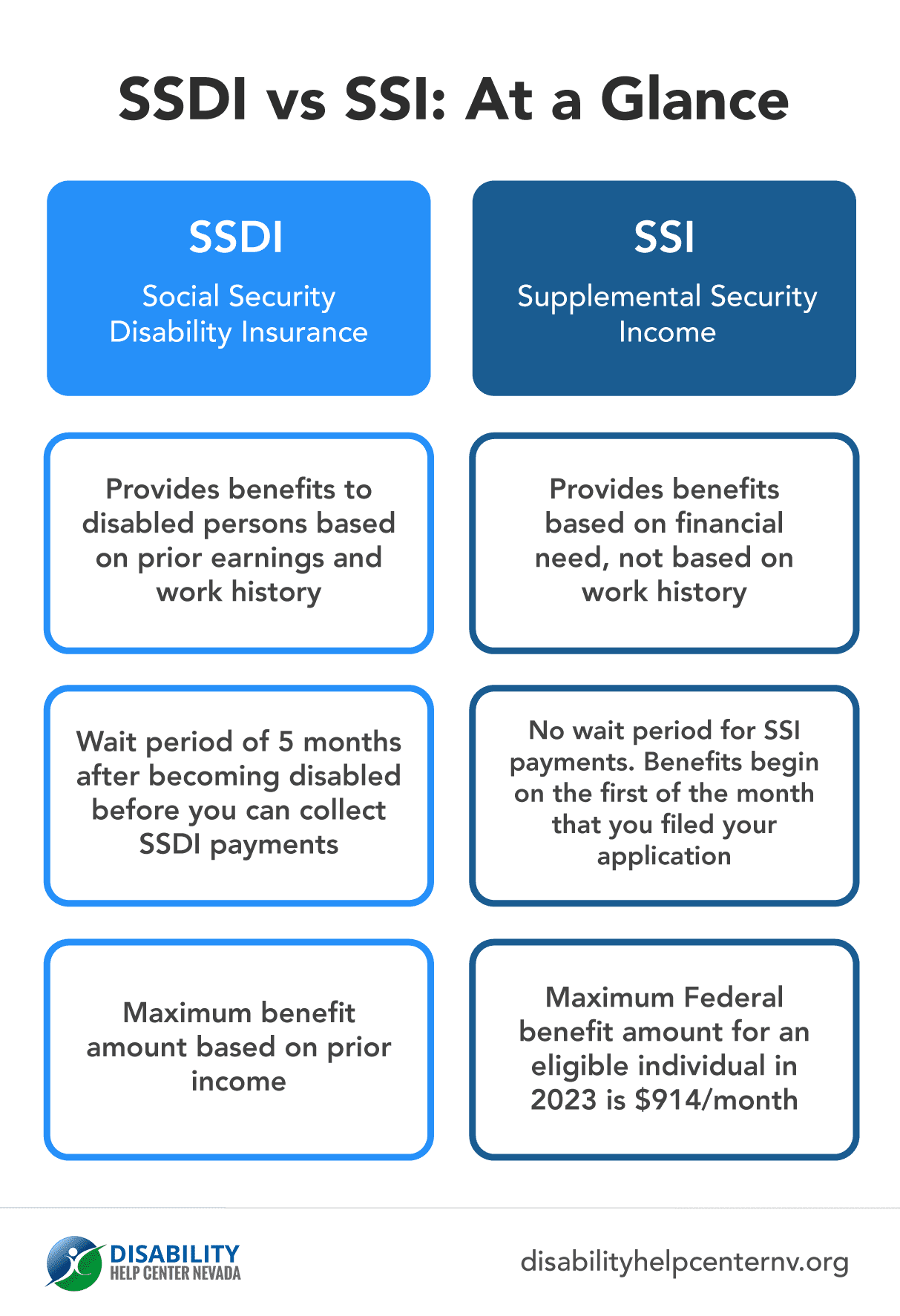

There are alot of options (potentially) when it comes to Medicare coverage.

However, there are a few not so well-known facts about Medicare coverage:

Plan availability is county-specific

You must have Part A & Part B to qualify for a Plan C

Having a Drug Plan is mandatory

There are three options for medicare coverage

Essential Resources:

- Medicare.gov: A comprehensive platform to explore available Medicare plans in the market, compare coverage options, and make informed decisions.

- Social Security Administration (800-772-1213): Contacting the SSA assists in setting up Medicare Parts A and B, ensuring seamless enrollment into the Medicare program.

- CMS – Medicare (1-800-633-4227): The Centers for Medicare & Medicaid Services provide valuable information and assistance regarding Medicare coverage, eligibility, and enrollment.

- Local Center for Aging: Every county typically has a Center for Aging or similar organizations that offer support and resources tailored to the needs of aging individuals and their caregivers. These centers provide guidance on Medicare, healthcare options, and community support services.

Conclusion: Navigating Medicare for a parent or relative involves careful consideration of various critical factors such as age, health issues, financial resources, and legal arrangements. By understanding these aspects and utilizing essential resources, caregivers can ensure that their loved ones receive the necessary healthcare coverage and support tailored to their needs. Establishing a Medical POA further streamlines decision-making processes, ensuring prompt and appropriate medical care when needed. With the right information and support, managing Medicare becomes a manageable task, promoting the health and well-being of aging loved ones.

In the vast landscape of online advertising, particularly on social media platforms like Facebook, it’s not uncommon to come across enticing offers that seem too good to be true. One such example is the often-promoted $3000 grocery card, capturing the attention of many unsuspecting users. However, it’s crucial to dig deeper and understand the fine print behind this seemingly generous offer, as it’s not as straightforward as it appears. In this post, we’ll unravel the truth behind the $3000 grocery card Facebook ad, exposing the misconceptions and shedding light on the reality of its availability and eligibility.

In the vast landscape of online advertising, particularly on social media platforms like Facebook, it’s not uncommon to come across enticing offers that seem too good to be true. One such example is the often-promoted $3000 grocery card, capturing the attention of many unsuspecting users. However, it’s crucial to dig deeper and understand the fine print behind this seemingly generous offer, as it’s not as straightforward as it appears. In this post, we’ll unravel the truth behind the $3000 grocery card Facebook ad, exposing the misconceptions and shedding light on the reality of its availability and eligibility. Navigating the intricacies of Medicare can be challenging, especially for individuals with specific healthcare needs. Two options that stand out in providing tailored care are the Chronic Special Needs Plan (CSNP) and the Dual Special Needs Plan (DSNP). In this blog post, we’ll delve into the details of CSNPs and DSNPs, exploring the different types available, the qualifications required, and the unique benefits they offer. It’s important to note that, in addition to having a qualifying condition and dual eligibility for DSNPs, both types of plans offer enhanced additional benefits, including grocery cards, generous dental, vision, and hearing benefits, in addition to zero to minimal cost-sharing for care. Many of these plans also offer care management services to make sure you are optimizing and coordinating the care the plan provides.

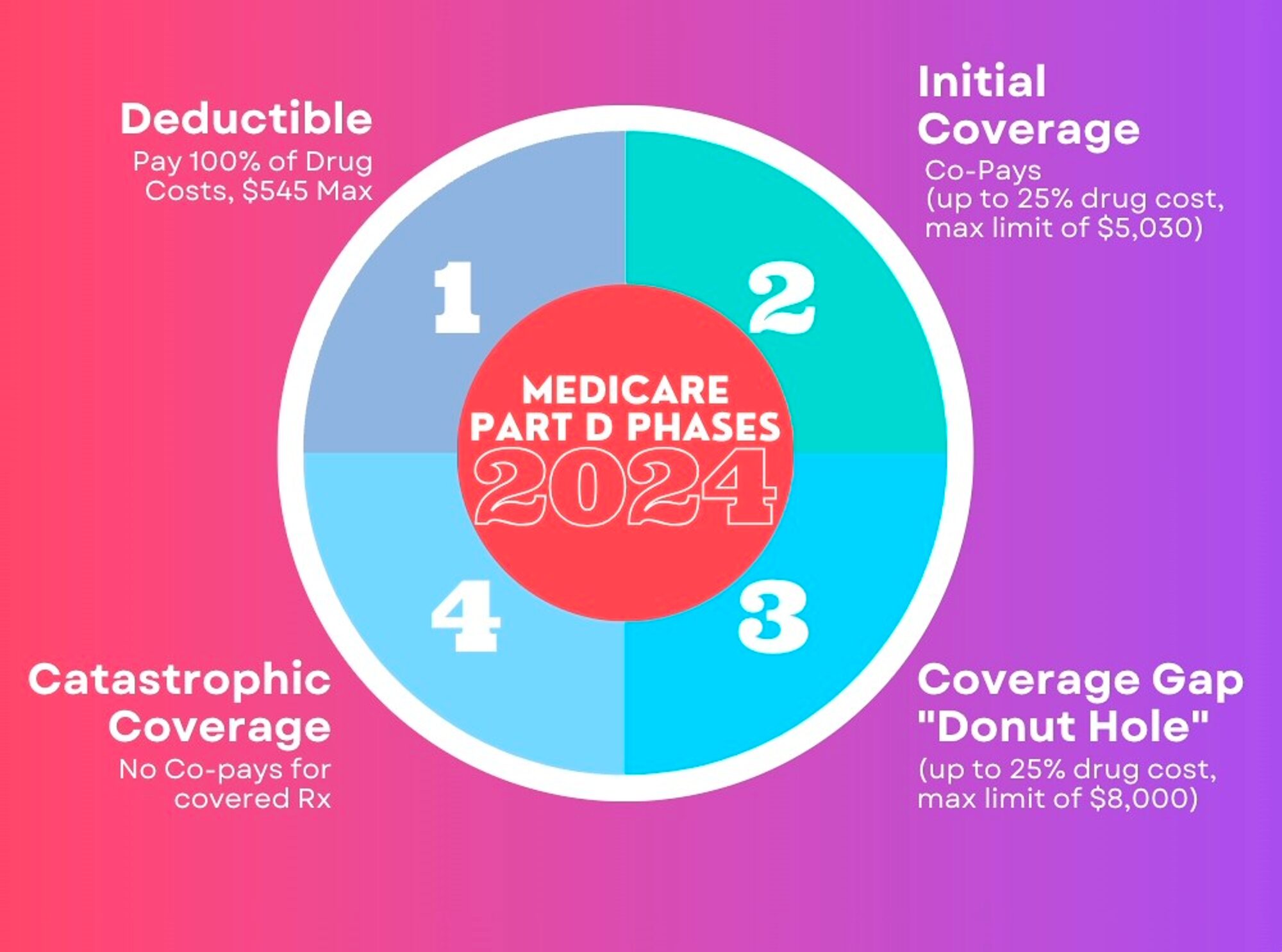

Navigating the intricacies of Medicare can be challenging, especially for individuals with specific healthcare needs. Two options that stand out in providing tailored care are the Chronic Special Needs Plan (CSNP) and the Dual Special Needs Plan (DSNP). In this blog post, we’ll delve into the details of CSNPs and DSNPs, exploring the different types available, the qualifications required, and the unique benefits they offer. It’s important to note that, in addition to having a qualifying condition and dual eligibility for DSNPs, both types of plans offer enhanced additional benefits, including grocery cards, generous dental, vision, and hearing benefits, in addition to zero to minimal cost-sharing for care. Many of these plans also offer care management services to make sure you are optimizing and coordinating the care the plan provides. For individuals not currently relying on prescription medications, the idea of investing in a Medicare Prescription Drug Plan might seem unnecessary. However, the importance of having prescription drug coverage extends beyond immediate medication needs. In this blog post, we’ll explore the reasons why having a Medicare Prescription Drug Plan is crucial, touching on the potential penalties for non-compliance and discussing alternative creditable coverage options.

For individuals not currently relying on prescription medications, the idea of investing in a Medicare Prescription Drug Plan might seem unnecessary. However, the importance of having prescription drug coverage extends beyond immediate medication needs. In this blog post, we’ll explore the reasons why having a Medicare Prescription Drug Plan is crucial, touching on the potential penalties for non-compliance and discussing alternative creditable coverage options. Lets get down to basics — Medicare is as easy as A,B,C & D

Lets get down to basics — Medicare is as easy as A,B,C & D Navigating Medicare Options: Understanding the Differences Between Medicare Supplement/MediGap Plans and Medicare Advantage Plans

Navigating Medicare Options: Understanding the Differences Between Medicare Supplement/MediGap Plans and Medicare Advantage Plans